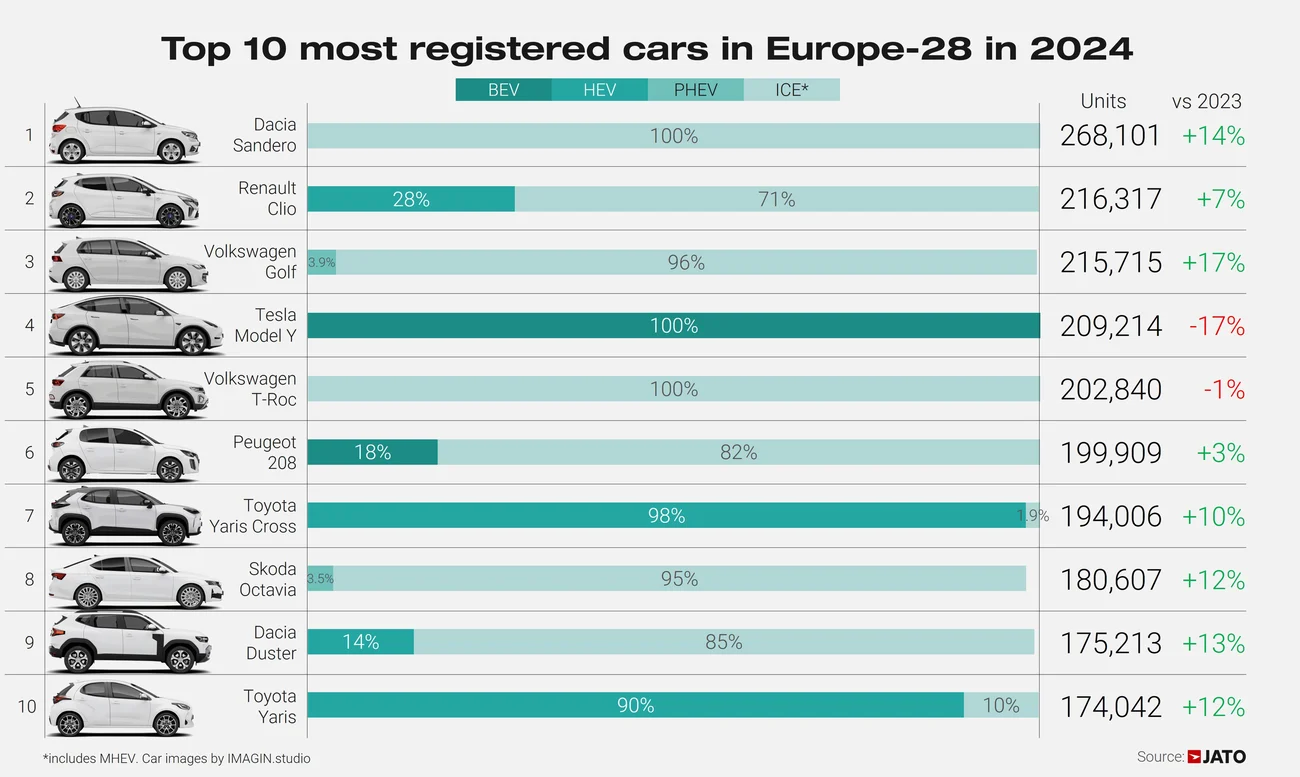

Tesla’s Model Y was the most registered battery-electric vehicle (BEV) in Europe in 2024, as shown in data released this week.

After landing the spot for Europe’s top-selling vehicle overall in 2023, the Model Y last year was the most-registered BEV and the fourth-most-registered vehicle overall, according to registration data shared by Jato Dynamics on Monday. The Model Y had 209,214 registrations in the region, marking a 17 percent drop year over year, only falling behind the top-selling Dacia Sandero (268,101), the Renault Clio (216,317) and the Volkswagen Golf (215,715).

Tesla’s Model 3 was the 27th most-registered vehicle with 112,789 units, marking a 12-percent increase year over year. The most registered brands in the index were Volkswagen, Toyota, BMW and Skoda, while Tesla was the 16th most-registered brand overall with 325,449 units registered in 2024.

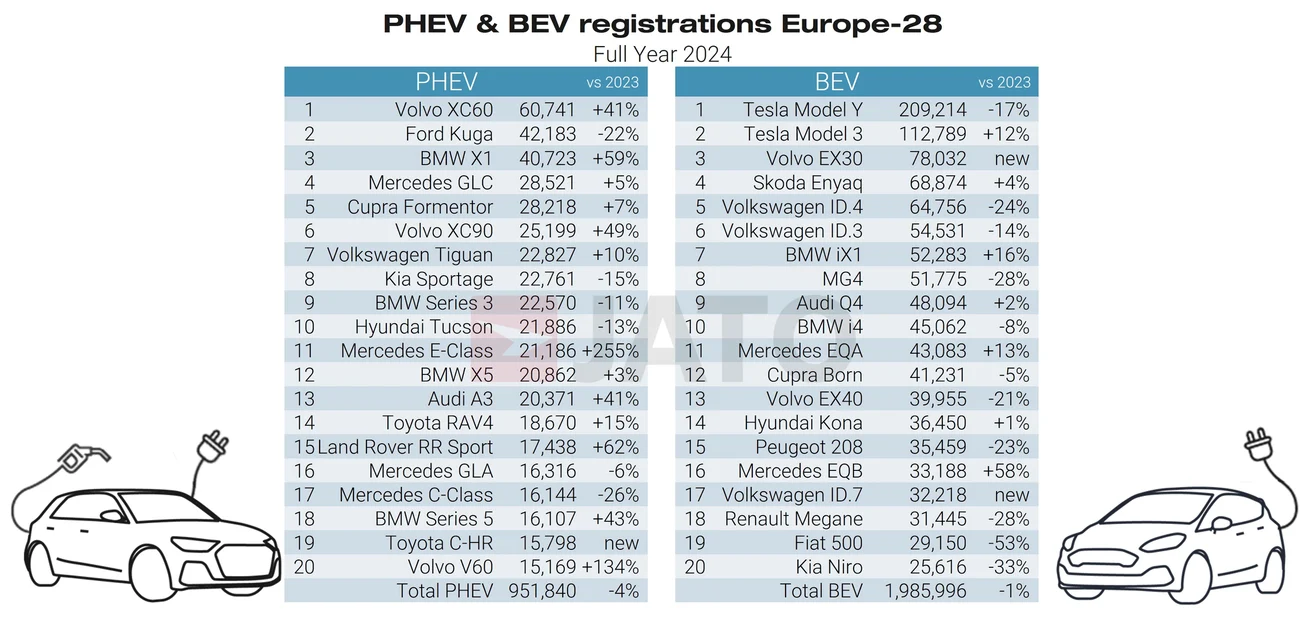

Other top-selling BEVs on the list included the Volvo EX30 (78,032), the Skoda Enyaq (68,874), and the Volkswagen ID.4 (64,756) and ID.3 (54,531), with total BEV deliveries in the region totaling 1.98 million for a 1 percent drop year over year.

You can see the top 10 most-registered models in Europe in 2024 below, as well as a breakdown of BEV registrations below that.

Credit: Jato Dynamics

Credit: Jato Dynamics

READ MORE ON BEVS IN EUROPE: Tesla launches crazy Supercharging incentive in Europe for Model Y

In its Q4 2024 earnings update letter, Tesla highlighted that the Model Y was once again the world’s best-selling vehicle in 2024, along with earning the top spot in multiple European countries. The Model Y was named the best-selling vehicle of any type in Denmark, Norway, Sweden, Switzerland and the Netherlands.

The news also comes as Tesla launches its refreshed Model Y design in markets around the world, with the vehicle now featuring lightbar-style headlights and taillights, as well as a number of other small interior and exterior changes. Tesla announced last week that it has started building the new Model Y at all four of its Gigafactories, which are located in Fremont, California, Austin, Texas, Shanghai, China, and Grünheide, Germany.

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send us tips at tips@teslarati.com.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

News

Tesla pushes crazy ‘Luxe’ incentive package on flagship Model S and X

Tesla is pushing more customers to the Model S and Model X with a new incentive package.

Tesla has pushed a crazy new incentive package, known as the “Luxe Package,” on the flagship Model S and Model X, along with a $10,000 price increase on each trim level.

The move aims to likely bolster margins for the company on the two cars while also giving those who choose to buy the Tesla lineup mainstays a variety of awesome advantages, including Free Supercharging, Full Self-Driving, and other add-ons.

Tesla is offering a crazy Supercharging incentive on its two ‘sentimental’ vehicles

Last night, Tesla launched the “Luxe Package” for the Model S and Model X, which includes the following four add-ons:

- Full Self-Driving (Supervised) – Your car will be able to drive itself almost anywhere with minimal driver intervention

- Four-Year Premium Service – Wheel and Tire Protection, Windshield Protection, and Recommended Maintenance

- Supercharging – Charge for free at 70,000+ Superchargers worldwide

- Premium Connectivity – Listen to music, stream movies, monitor live traffic, and more – no Wi-Fi needed

Full Self-Driving is priced at $8,000. Free Supercharging for the life of the car is between $10,000 and $15,000 over the life of the vehicle, although Tesla has valued it at $5,000 in recent promotions.

Free Premium Connectivity is roughly $1,000, and the four-year tire, wheel, windshield, and maintenance plan is about $3,200.

🚨 Tesla increased the price of both the Model S and Model X by $10,000, but both vehicles now include the “Luxe Package,” which includes:

-Full Self-Driving

-Four years of included maintenance, tire and wheel repairs, and windshield repairs/replacements

-Free lifetime… pic.twitter.com/LKv7rXruml— TESLARATI (@Teslarati) August 16, 2025

In all, the value is over $25,000, but this is loosely based on usage.

The Model S and Model X are low contributors to Tesla’s overall sales figures, as they make up less than five percent of sales from a quarterly perspective and have for some time.

As they are certainly the luxury choices in Tesla’s lineup, the Model 3 and Model Y are the bigger focus for the company, as a significantly larger portion of the company’s sales is made up of those vehicles.

The Luxe Package is an especially good idea for those who drive high-mileage and plan to use the Model S or Model X for commuting or long drives. The free Supercharging makes the deal worth it on its own.

As for the price bumps, each of the vehicles are now priced as follows:

- Model S All-Wheel-Drive: $94,990

- Model S Plaid: $109,990

- Model X All-Wheel-Drive: $99,990

- Model X Plaid: $114,990

News

Tesla Roadster could have a formidable competitor with BYD’s 3000-HP supercar

The Roadster is one of the most anticipated vehicles of all time, especially because we’ve all had to wait so long for it. On its own, it will have a 1.9-second 0-60 MPH acceleration rate, which is projected to be better than the 2.3 seconds the U9 Track Edition will offer.

The Tesla Roadster is on the way, and yes, we know we’ve heard that for quite a few years. But when it comes, it might have a formidable competitor, and it might come from no one other than Chinese rival BYD.

BYD’s Yangwang U9 Track Edition is a new configuration of the U9 supercar that hit the Chinese Ministry of Information Technology (MIIT) database recently.

The vehicle was first spotted on the MIIT database by CarNewsChina. It will have a quad-motor powertrain, each dedicated to one wheel. Instead of the 1,287 horsepower that comes with the standard U9 configuration, the Track Edition will have 2,977.

There are only two cars that even come close in terms of horsepower: the Lotus Evija with 1,972 and the Rimac Nevera at 1,914 horsepower. The Tesla Roadster is expected to have somewhere around 1,000 horsepower.

The Roadster is one of the most anticipated vehicles of all time, especially because we’ve all had to wait so long for it. On its own, it will have a 1.9-second 0-60 MPH acceleration rate (without the SpaceX package, which brings the projection to 1.1 seconds), which is projected to be better than the 2.3 seconds the U9 Track Edition will offer.

The Roadster also beats the U9 Track Edition in projected top speed and range. The Roadster could top out at over 250 MPH, compared to the 217 conservative projection for the U9 Track Edition.

Range on the Roadster is 620 miles, beating 280 miles for the BYD.

- Credit: BYD

- Credit: BYD

The U9 Track Edition will also have some additional features compared to its base model. These include some aerodynamic additions, like a carbon fiber rear wing, diffuser, and an adjustable front splitter and adjustable rear wing.

The latter two are optional, but if you have enough scratch to drop on this car, you’re probably adding those two features as well.

We hope that both the Roadster and U9 Track Edition will hit a drag strip, road course, or even a superspeedway for some racing. It would truly be something for EV fans to drool over.

News

Tesla is breaking even its own rules to cap off an intense Q3

Tesla is pulling out all the stops to have a strong Q3 as the EV tax credit will phase out.

Tesla is breaking its own rules by advertising on various platforms in an effort to sell as many cars as possible before the end of the $7,500 electric vehicle tax credit.

Tesla has had a very polarizing perspective on advertising. Over the years, it has taken on different attitudes toward spending any money on marketing. It has instead put those dollars into research and development to make its vehicles more advanced.

Back in 2019, Tesla CEO Elon Musk talked about the company advertising its vehicles and energy products:

Tesla does not advertise or pay for endorsements. Instead, we use that money to make the product great. https://t.co/SsrfOq1Xyc

— Elon Musk (@elonmusk) May 19, 2019

In 2021, in response to analyst Gary Black, who has pushed for Tesla to have a PR or marketing department, Musk said:

Other companies spend money on advertising & manipulating public opinion, Tesla focuses on the product.

I trust the people.

— Elon Musk (@elonmusk) April 27, 2021

However, this did not hold as Tesla’s strategy for the long haul. While Musk did resist advertising for a long time, Tesla started placing ads on platforms like X, Google, and YouTube several years back. It’s pretty rare that Tesla pushes these ads, however.

Tesla launches advertising on X in the U.S., expanding ‘small scale’ strategy outlined by Musk

The company’s stance on setting aside capital for advertising seems to be circumstantial. Right now, it is working to sell as many vehicles as it can before the tax credit comes to a close.

As a result, it is pushing some ads on YouTube:

$TSLA is starting to advertise on YouTube. pic.twitter.com/1cwO2KNzJm

— Cole Grinde (@GrindeOptions) August 15, 2025

It’s a move that makes sense considering the timing. With just six weeks roughly left in the quarter, Tesla is going to work tirelessly to push as many cars into customer hands as possible. It will use every ounce of effort to get its products on people’s screens.

Tesla counters jab at lack of advertising with perfect response

Throw in one of the many incentives it is offering currently, and there will surely be some takers.

-

Elon Musk1 week ago

Elon Musk1 week agoElon Musk teases crazy new Tesla FSD model: here’s when it’s coming

-

Elon Musk1 week ago

Elon Musk1 week agoElon Musk confirms Tesla AI6 chip is Project Dojo’s successor

-

News1 week ago

News1 week agoTesla Model Y L reportedly entered mass production in Giga Shanghai

-

Elon Musk1 week ago

Elon Musk1 week agoTesla CEO Elon Musk details massive FSD update set for September release

-

Cybertruck1 week ago

Cybertruck1 week agoTesla’s new upgrade makes the Cybertruck extra-terrestrial

-

News5 days ago

News5 days agoElon Musk reaffirms Tesla Semi mass production in 2026

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla ‘activist shareholders’ sue company and Elon Musk for Robotaxi rollout

-

News1 week ago

News1 week agoElon Musk explains why Tesla stepped back from Project Dojo