When the partners in LNG Canada were looking to invest in a major new liquefied natural gas project somewhere in the word, British Columbia wasn’t exactly the only belle at the ball.

Royal Dutch Shell, Petronas and Mitsubishi have a number of new LNG projects on the drawing board around the world.

But despite the fact an LNG plant in Kitimat will cost twice as much to build as a plant on the U.S. Gulf Coast, will require a new $6.2 billion pipeline, and required the consent and cooperation of more than two dozen First Nations, those companies decided to spend $40 billion here, not somewhere else.

B.C. has the advantage of short shipping distances to Asia, and massive amounts of natural gas in the Montney formation in B.C.

But for the project to work, B.C. had to take a hard look at competitiveness, and the new NDP government ended up agreeing to scrap a suite of new LNG taxes that the previous Liberal government had enacted in anticipation of an LNG industry that ended up stalling.

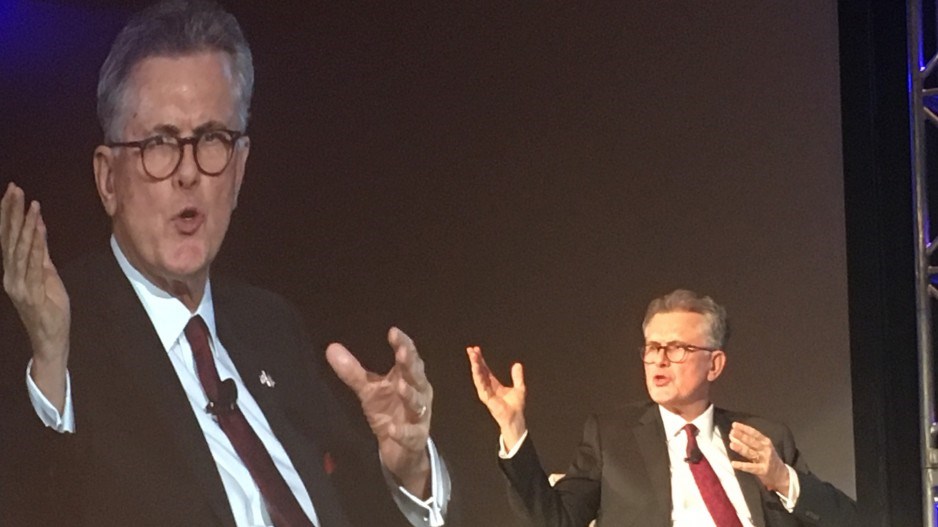

Premier John Horgan told the BC Business Summit Friday November 16 that his government insisted that any LNG project would have to meet four conditions, including addressing First Nations and environmental issues, and ensuring B.c. got its fair share of revenue and jobs.

“They came back to us and said, ‘Well that’s fair enough. We can achieve those. But we have a few issues as well with respect to competiveness of British Columbia as a location for the type of investments that the joint venture partners wanted to make.’ We had a competitiveness gap that we had to close.”

Competitiveness has, in fact, become a major concern for Canadian businesses and foreign investors. It was the topic of discussion by Horgan and LNG Canada CEO Andy Calitz at the BC Business Summit hosted by the Business Council of BC.

Billions of dollars worth of energy projects, including pipelines, have been killed or delayed in Canada in recent years by regulatory inertia and opposition from environmentalists and First Nations.

The result of cancelled and delayed oil pipelines is a deep discount on Canadian oil that is costing the Canadian economy billions.

Both Horgan and Calitz suggested that the $40 billion final investment decision by the LNG Canada partners addresses some of that cynicism.

“The critics said it shouldn’t be done, and the naysayers it couldn’t be done, and in some ways the FID decision on LNG Canada addressed both of those in a kind of fundamental and final way,” Calitz said.

Horgan suggested the LNG Canada project could open the door to more foreign investments in B.C.

“I would argue that because of the extraordinary success that we as British Columbians and Canadians have had working with offshore investment to tap into our abundance of natural resources, particularly natural gas, is an opportunity for other investment opportunities,” Horgan said.

While LNG Canada managed to tick off all the required boxes, including inking benefits agreements with more than 20 First Nations, Calitz warned that Canada needs to address regulatory uncertainties for other projects.

When he first arrived in Canada to lead the LNG Canada project in 2013, Calitz said he didn’t realize that it would take “17,000 engagements with regulators and First Nations.”

And he said the “interprovincial friction” that he saw erupt between B.C. and Alberta and the federal government over the Trans Mountain pipeline had reached what he said were “untenable levels.”

Asked what governments need to do to address uncertainties for investors in Canada, Calitz pointed to First Nations consultations.

“First would be absolute clarity about what constitutes First Nations consultation,” he said.

“It is very clear that Canada is struggling to define what is ‘adequacy,’” he said. “Whether it comes out of the current regulatory regime, or the C-69, regime, that has to be clarified.”

Asked how to address environmental activism, Calitz simply pointed to the environmental upside of LNG.

Although the project will produce 3.5 million tonnes of greenhouses gases, Calitz said it will displace coal use in China, Korea and Japan for a net reductions of GHGs.

“With gas having previously flown across the U.S. border, the Canadian mindset has to change to say, ‘What does it do here in Canada, and which problems does it solve in China, Korea and Japan together’?”

Horgan said investors who want to build projects in B.C. need to work with First Nations, address their concerns and ensure they benefit, or projects will fail.

“Investors who deny that absolute certainty of history, and that absolute certainty of law with respect rights and title are not going to be successful,” he said. “It’s just that simple. That’s not John Horgan, the NDP guy, saying that – that’s the courts. That’s the rule of law.”

Construction on the LNG Canada project has already begun with site preparation in Kitimat, where the plant will be built. During construction, it will create roughly 7,500 jobs. The associated Coastal GasLink pipeline will generate roughly 2,5000 jobs. Additional jobs will also be created in Northeastern B.C. through additional natural gas well development.

Once built, the project will provide roughly 1,000 permanent jobs and provide an estimated $22 billion in tax and royalty revenue to the province over 40 years.