Kamyab Jawan Program Loan freshly originated the confirm status button in the form of Track. Prime Minister’s Kamyab Jawan – Youth Entrepreneurship Scheme (YES) emerged as famous Loan Scheme b/w the youngsters of all over Pakistan which announced by beloved PM Imran Khan. Over 25, 9800 Online Loan form submitted now. Moreover, in Kamyab Jawan Program Team began the functionality of Track.

Introduction

Kamyab Jawan Program Loan, for young business people and existing businesses b/w the age of 21 to 45 years, is dedicated to giving sponsored investment through 21 Advertisement, JS Bank, First Woman Bank Limited, Faysal Bank Limited Dubai Islamic Bank, Bank Al Falah, and much more banks under the control of the State Bank of Pakistan.

The credits SME recipients out in Pakistan, these are Punjab, Sindh, Khyber Pakhtunkhwa, Balochistan, Gilgit Baltistan and Azad Jammu and Kashmir.

More Read: How to Check Land Record Online In Pakistan

Credits gave through Kamyab Jawan Program are isolated in three levels:

Level 1: The loan Range b/w 100,000 to 1 million PKR

Level 2: The loan Range b/w 1 million to 10 million PKR

Level 3: The loan Range b/w 10 million to 25 million PKR

The credits are provided a time of as long as eight years with a beautiful time of 1 year. The Borrower responsibility of equality would be as money and will be needed after the approval of the loan.

1. New Businesses

The latest business needed a debt to equity ratio;

Tier 1: 90:10 @ 3% markup

Tier 2: 80:20 @ 4% markup

Tier 3: 80: 20 @ 5% markup

2. Living Businesses

- No equity participation is needed of existing businesses applying for the trust.

- SMEDA tasked with an advisory role of the PM scheme.

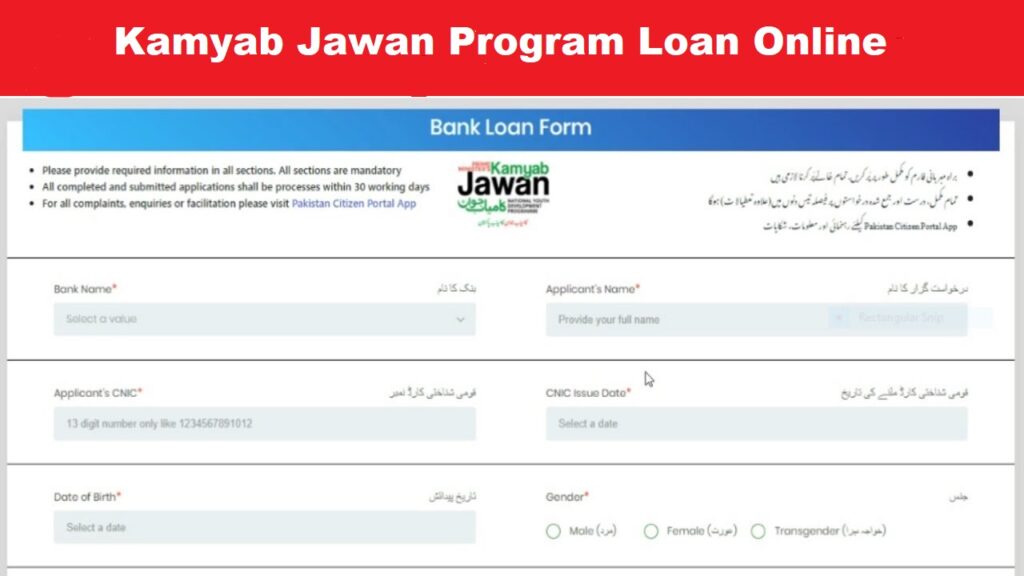

Yes! Application Form

- Please provide the needed data in every part as any parts are necessary.

- For any complaints, please visit Pakistan Citizen Portal App.

Please fill in the needed areas of Applicant CNIC, Issue date and Date of birth accurately as they confirmed by Nadra.

What Is The Best Occupation Of Trust?

In Kamyab Jawan Program Loan, the best occupation for repayment of trust is eight years, containing a maximum of a one year time. Moreover, the specific loan term and elegance time for each loan depends on the kind of business, judgment and choice making of cooperating banks.

How Much Equity Do I Need To Pay From My Own Sources?

Please note that investment is just needed for new trades for loans equal to Rs. 100,000 and up to Rs 1 million, the minimum equity required is 10% while for loans above Rs. 1 million up to Rs. 25 million, the minimum equity needed is 20%. Living trusts have not required any investment.

How and where can I get information about this scheme?

Total information about the loan scheme is accessible on kamyab jawan program loan. Moreover, you can communicate the nearest branches of cooperating banks for administration and support.

Who Can Apply?

- Every men/woman, including CNIC, aged b/w 21 and 45 years, are eligible. For IT and E-Commerce businesses, the age limit will be 18 years.

- Short and average businesses as per the description of State Bank of Pakistan and held by youth as per age discussed above also acceptable

- For IT and eCommerce related businesses, at least matriculation or equivalent study will be needed

Which Banks Are Cooperating In This Scheme?

Following banks are cooperating in this scheme:

- JS Bank Limited

- First Woman Bank Limited

- Faysal Bank Limited

- Dubai Islamic Bank Limited

- Bank Al Falah

- Askari Bank Limited

- AL Baraka Bank Limited

- Bank of Punjab

How Can Apply For This Loan?

- Physical form of Kamyab Jawan Program Loan is not provided

- You can apply Online Now

- Complete the form at the following link and submit:

Prime Minister’s Kamyab Jawan – Youth Entrepreneurship Scheme (YES)